The chill that gripped Canada’s housing market after the Bank of Canada raised interest rates earlier in the year has turned several degrees cooler.

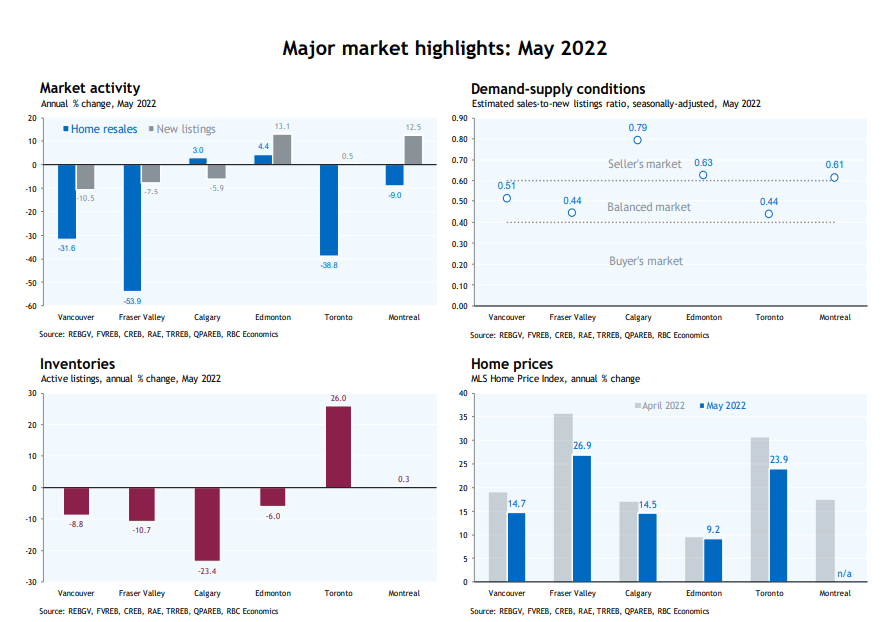

Many of Canada’s most expensive markets, including Toronto, Vancouver and Montreal, as well as Ottawa, Ottawa, Hamilton, saw their sales decline in May. This was the third month of decline for many.

Robert Hogue , assistant chief economist at RBC, stated that “Clearly the Bank of Canada has raised interest rates since March and there are prospects for more”. They’re raising the bar for buyers and lowering earlier (super-bullish) sentiment.

Since March, the central bank has increased its key rate three more times, from 0.25 to 1.5%. Economists expect that it will continue increasing until it reaches 2.5%.

Hogue stated tha Canada’s housing market is now undergoing rapid rebalancing.

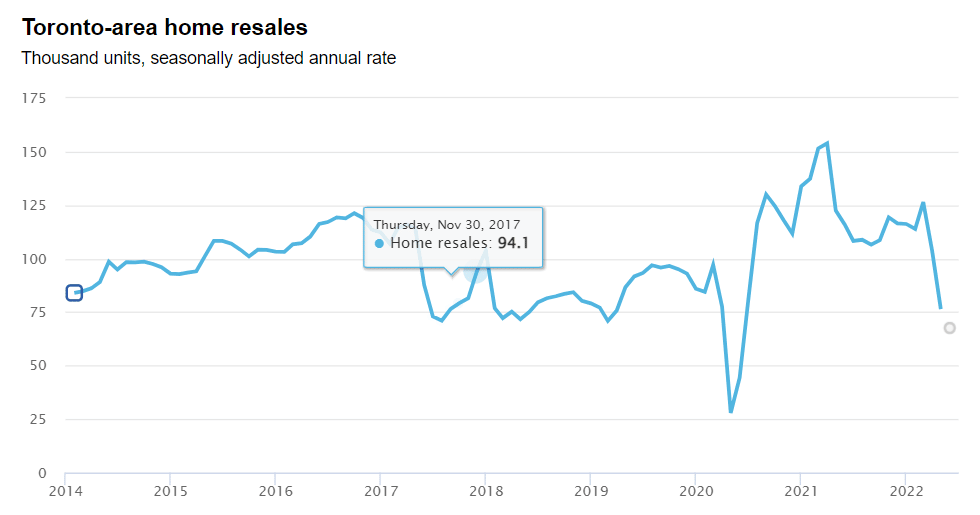

The Toronto-area market has seen a dramatic change in the last three months. The demand-supply situation has changed from being the tightest in records to almost as loose as it was during the 2017 correction. Due to the high interest rate sensitivity of buyers due to the large mortgage sizes and the steep prices in the area, the Bank of Canada’s rate increase campaign has left them on guard. In the last three months, home resales fell by a third.

This includes a 9.3% m/m decrease in May (seasonally adjusted). After falling to historic lows during the pandemic in 2004, inventories are rising and have risen 26% over May 2012. The buyers’ urgency and willingness to participate in bidding wars has decreased significantly. In April and May, the MLS Home Price Index declined m/m. The strongest headwinds are being felt by single-detached homes in the 905 belt, which had seen their values rise the most over the past year. The City of Toronto condos have shown greater resilience. As buyers gain pricing power, we expect prices to continue falling.

This was particularly evident in Toronto where “demand-supply conditions swung close to the tightest records to nearly as loosely as during the 2017 correction,” he stated.

Source: Canadian Real Estate Association, Toronto Region Real Estate Board, RBC Economics | *Yellow dot indicates estimate for May 2022

Source: Canadian Real Estate Association, Toronto Region Real Estate Board, RBC Economics | *Yellow dot indicates estimate for May 2022

According to RBC’s seasonally adjusted estimate and the MLS Home Price Index, Vancouver was Canada’s most expensive market. Home resales dropped more than 15% compared to the previous month. Although inventories are still lower than the previous year, they increased.

Hogue wrote that Vancouver buyers are the most rate-sensitive in the country. He believes they will be severely affected by the Bank of Canada increasing their interest rates by 100 basis points. RBC expects that buyers will negotiate better prices with sellers in the future.

Montreal, where sales fell below pre-pandemic levels one year ago, has been on the path to a soft landing longer than other markets. Hogue stated that the notable development in May was a significant increase in new listings. Prices have risen so far, but this could change if there is more supply.

Calgary’s lower prices have made it a busy market in recent years. Although three rate increases have slowed the pace of activity, Hogue said that it is still “incredibly bustling”.

The supply is tight and home resales are still well above the pre-pandemic peak levels. The cooling effect is most evident in the prices. They rose slightly in April, but were flat in May. This is a significant change from blockbuster gains earlier.

Brampton housing markets are finally moving back towards balance. The supply is finally catching up with demand so prices are stabilizing. Get a good deal on your next house, before prices go up again! Visit our blog for more information about Brampton housing market trends.

(Source)