The Canadian commercial real estate market is a fertile ground for savvy investors and businesspersons looking for lucrative opportunities. Despite global economic uncertainties, this sector has demonstrated remarkable resilience and adaptability. Now is considered a prime time to dive into commercial real estate investments, as current trends and market dynamics suggest a promising horizon for those ready to capitalize on this vibrant market.

Current Trends in Canadian Commercial Real Estate

The landscape of commercial real estate in Canada is undergoing rapid evolution, influenced by several key trends:

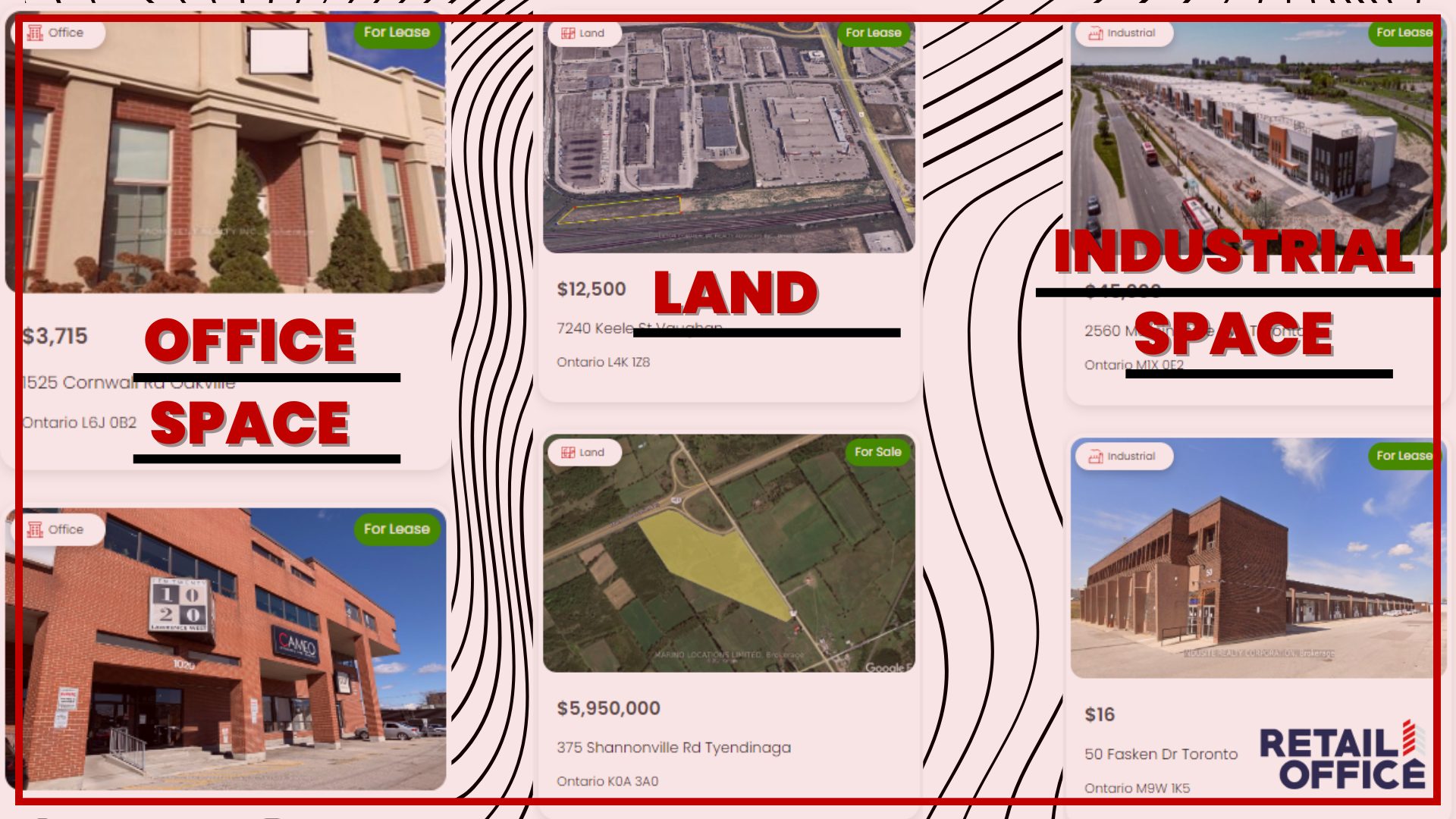

Warehouse and Logistics Spaces: The e-commerce boom has significantly increased the demand for warehouse and logistics facilities. This trend is reshaping much of the suburban and industrial outskirts of major cities as companies seek to optimize their supply chain and delivery mechanisms.

Retail Transformations: With a shift towards experience-based shopping, retail spaces are being redesigned to attract more foot traffic. Malls and storefronts are increasingly incorporating experiential elements like cafes, interactive displays, and event spaces to keep consumers engaged.

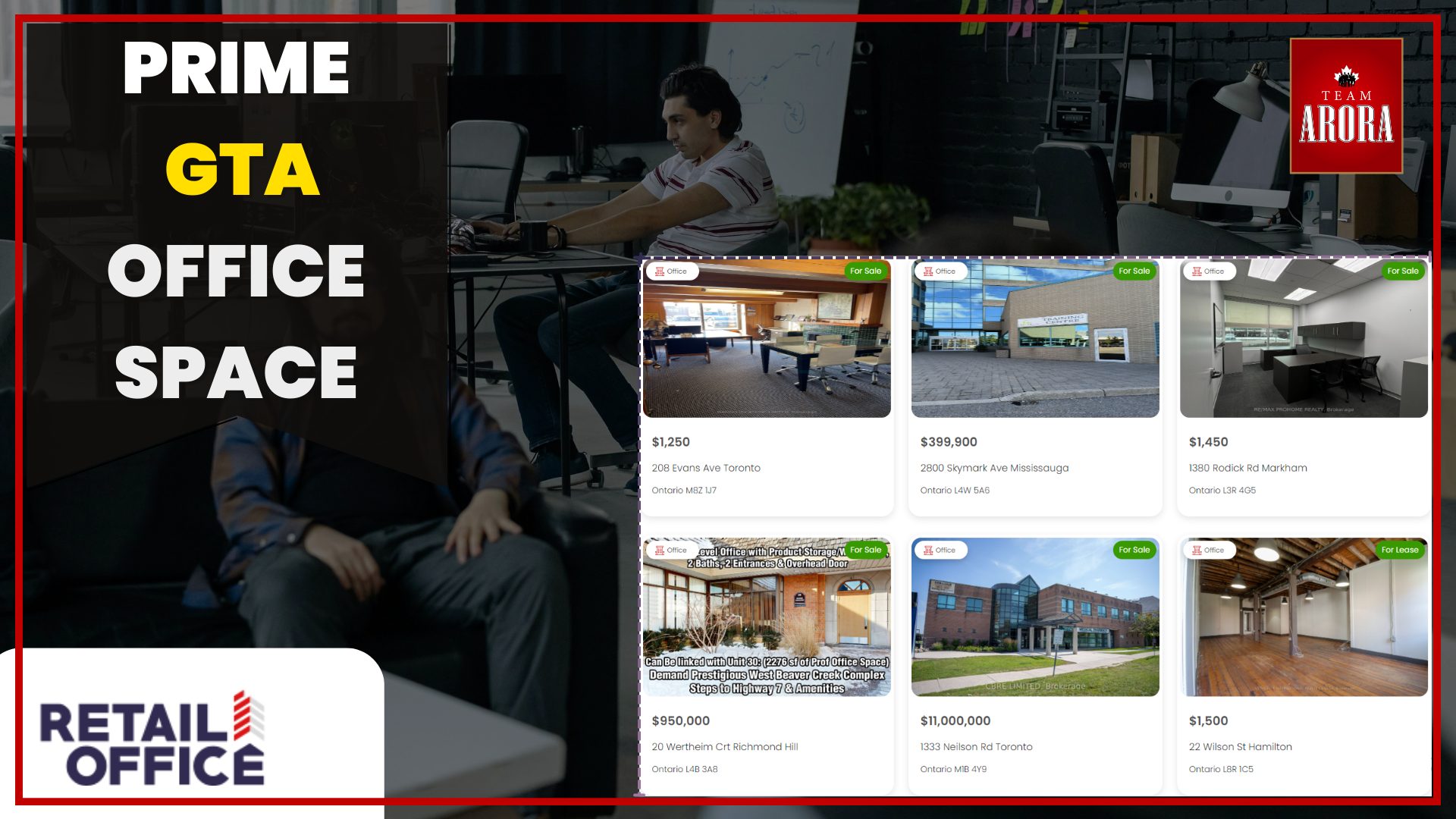

Flexible Workspaces: The office sector is not left behind, with a growing trend towards flexible workspaces. These accommodate hybrid work models, catering to both remote and in-office demands, reflecting the changing nature of work post-pandemic.

Prime Investment Hotspots

Key cities are leading the charge in the commercial real estate boom:

Toronto: Known for its robust financial services, Toronto offers lucrative opportunities in both the office and retail sectors. Its thriving economy makes it a safe bet for commercial investors.

Vancouver: Driven by a tech boom, Vancouver continues to see a surge in demand for office spaces, particularly in areas known for tech startups and digital enterprises.

Calgary: Benefiting from the recovery in energy prices, Calgary’s commercial property market is experiencing a revitalization, making it an attractive spot for energy-related businesses.

Evaluating Commercial Real Estate Investments

Investing in commercial real estate involves careful consideration of several critical factors:

Location: Properties in prime locations with high traffic or strategic access to transportation hubs typically offer better prospects for long-term returns.

Tenant Quality: Properties leased to reputable and financially stable tenants tend to yield consistent returns and lower vacancy rates.

Lease Terms: Properties with longer lease agreements provide stability in cash flow, an essential factor for continuous revenue.

Market Conditions: A deep understanding of both current and projected market conditions is crucial for timing your investments effectively, ensuring maximum profitability.

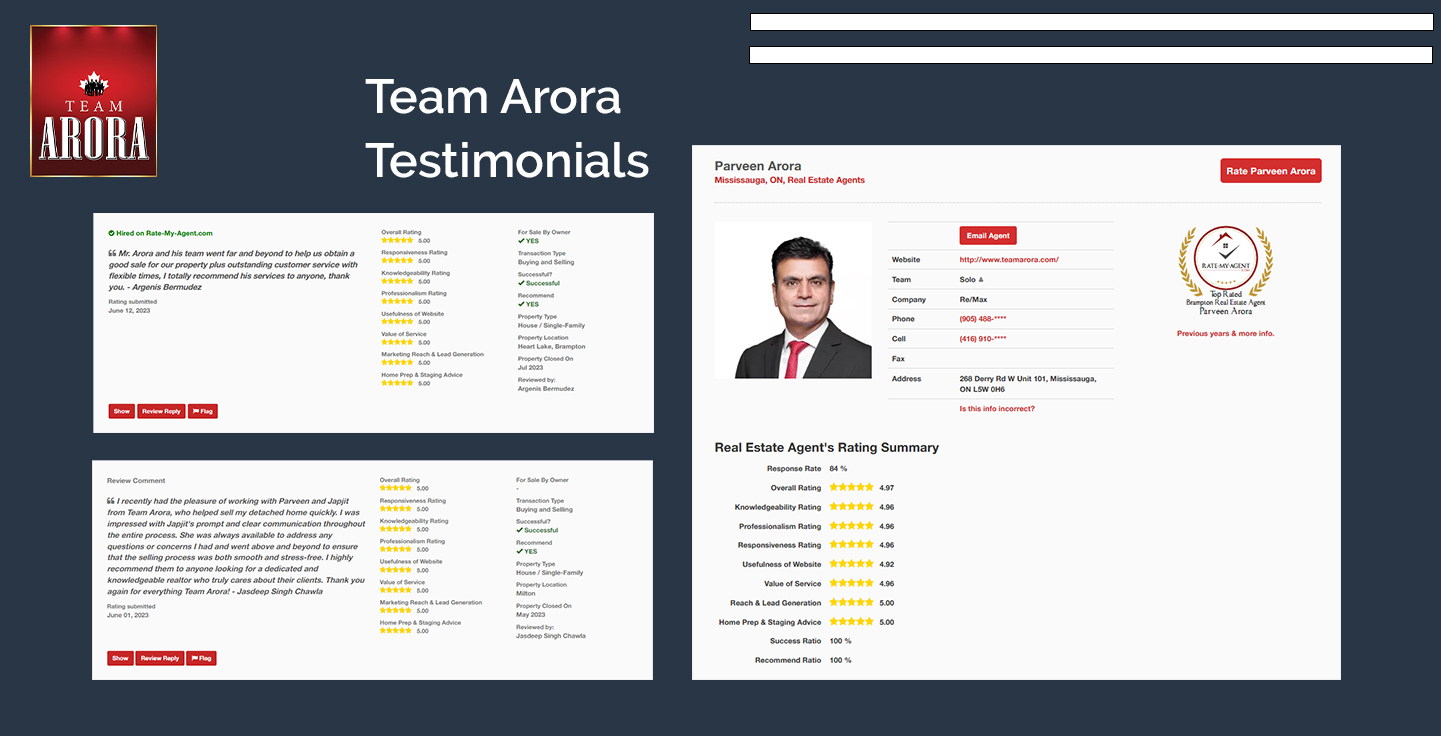

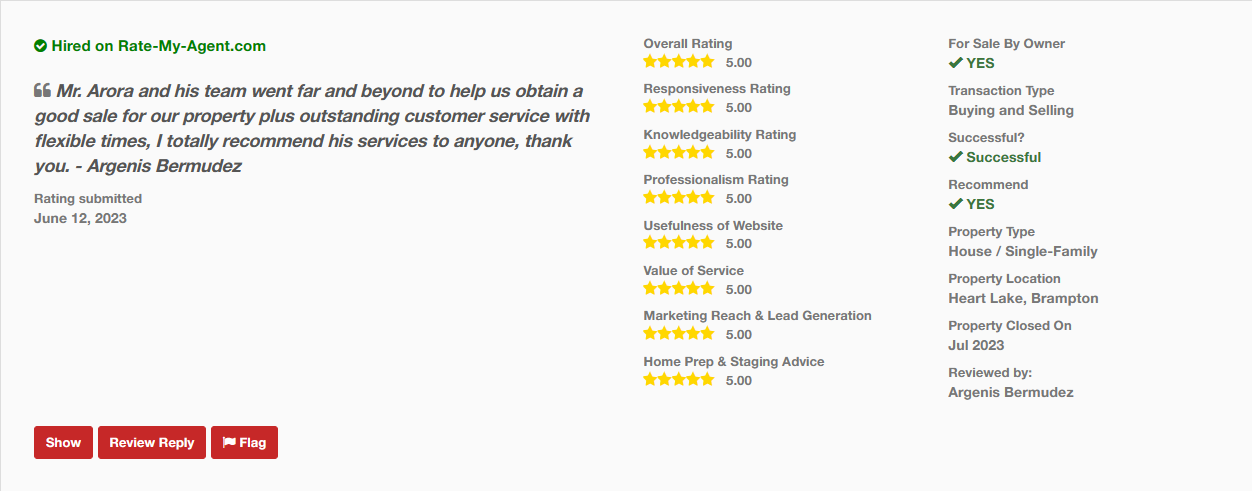

Investing in commercial real estate is not just about buying property; it’s about strategic planning and understanding market dynamics to ensure that every investment provides the best possible returns. Whether you’re new to the market or looking to expand your portfolio, considering these elements can provide a roadmap to successful investment in Canada’s booming commercial real estate sector.

Investment Strategies for Success

Investing in commercial real estate offers several pathways, each with its own set of benefits and considerations. To maximize returns and manage risks effectively, consider these strategic approaches:

Direct Purchase: This traditional method of buying property directly offers investors complete control over their investments. It allows for hands-on management and decision-making, providing opportunities to add value and increase returns through active involvement.

Real Estate Investment Trusts (REITs): For those who prefer a hands-off investment approach, REITs are an excellent option. They allow individuals to invest in portfolios of commercial properties without dealing with the day-to-day management of those properties. REITs are known for providing high dividend yields in addition to real estate appreciation.

Syndicated Investments: By pooling resources with other investors, you can participate in larger, potentially more lucrative commercial real estate projects. Syndication can significantly lower the individual investor’s capital requirement and spread the risks across a wider base.

Harnessing Opportunities for Growth

The Canadian commercial real estate market presents abundant opportunities for those eager to broaden their investment horizons. Whether you’re a seasoned investor or just starting out, the landscape is ripe for those ready to tap into its potential. With careful strategic planning and a deep understanding of the current market dynamics, investors can realize substantial growth and long-term profitability.

From bustling urban centers to expanding suburban locales, the diversity of properties available means there are numerous ways to achieve investment success in this robust market. Consider leveraging the different investment strategies mentioned to optimize your portfolio according to your financial goals and risk tolerance. Now is an opportune time to consider commercial real estate as a valuable component of your overall investment strategy.