The Canadian real estate market is thriving, with retail properties playing a pivotal role in the economic landscape. Understanding the dynamics of land development, office spaces, industrial properties, and retail properties is essential for investors looking to maximize their returns. This blog aims to provide comprehensive insights into these areas, highlighting opportunities and challenges in the retail property sector.

Understanding Retail Properties

Retail Properties: A Definition

Retail properties are commercial spaces designed for selling goods and services directly to consumers. These include shopping malls, standalone shops, and retail parks.

Importance of Location and Demographics

Location is critical in retail real estate. Proximity to populated areas, easy access, and visibility can significantly impact the success of a retail property. Understanding local demographics helps tailor the retail mix to meet consumer needs.

Current Trends in Retail Properties

The retail property market is evolving. Trends such as the rise of e-commerce, the demand for experiential retail, and the shift towards mixed-use developments are reshaping the landscape.

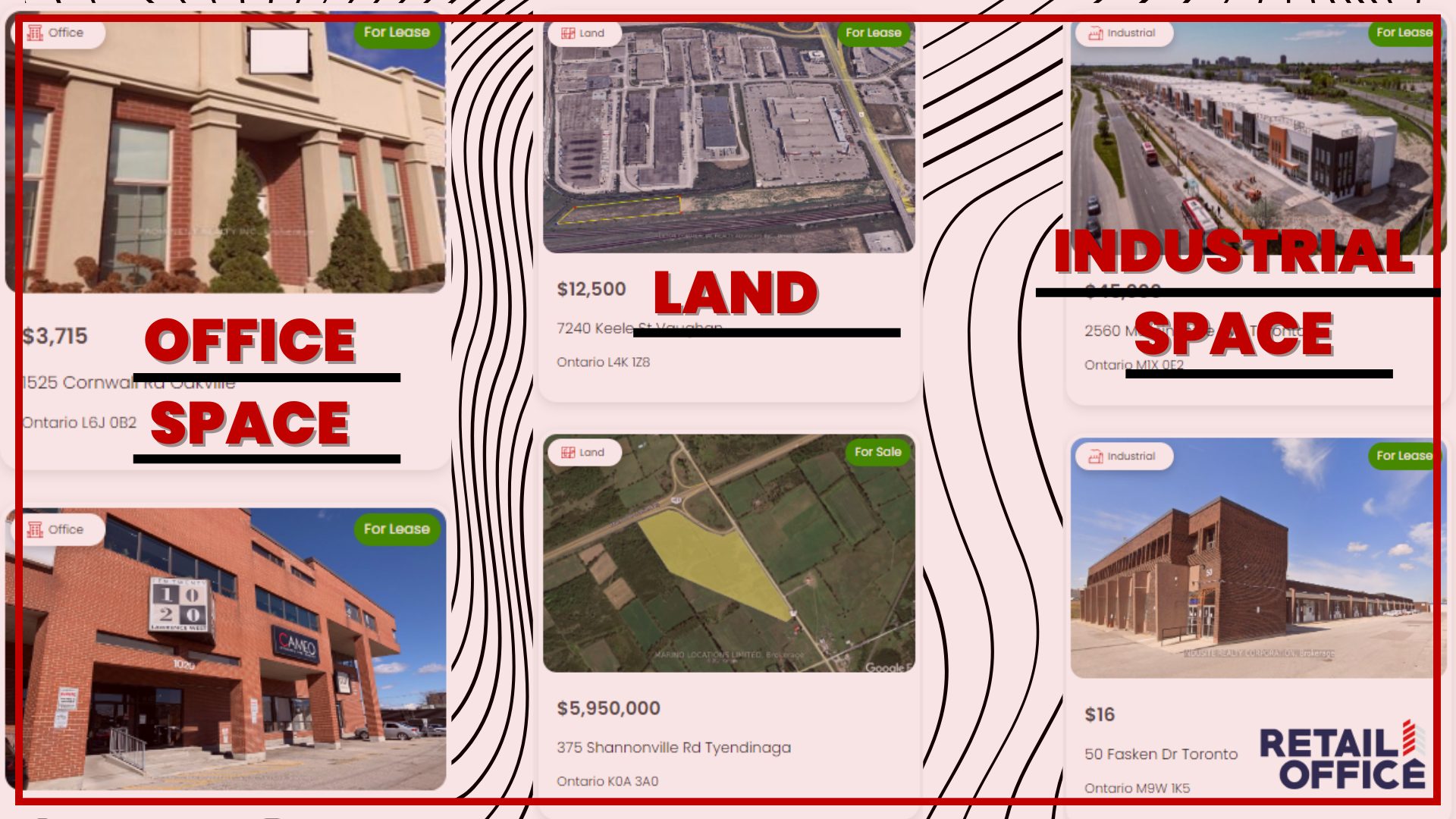

Land Development for Retail Properties

Key Considerations in Land Development

Successful land development for retail properties requires careful planning. Key considerations include site selection, environmental impact assessments, and infrastructure development.

Zoning Laws and Regulations

Zoning laws dictate how land can be used. Understanding local regulations is crucial for developers to ensure compliance and avoid legal issues.

The Role of Infrastructure and Accessibility

Good infrastructure and accessibility are vital for retail properties. This includes transportation links, parking facilities, and pedestrian pathways.

Case Studies of Successful Land Development Projects

Examining successful projects can provide valuable insights. For example, the redevelopment of Toronto’s Distillery District into a vibrant retail and cultural hub demonstrates the potential of thoughtful land development.

Office Spaces and Their Synergy with Retail

The Rise of Mixed-Use Developments

Mixed-use developments combine residential, commercial, and retail spaces, creating vibrant, multifunctional areas. This trend is growing in popularity across Canada.

Benefits of Integrating Office Spaces with Retail Properties

Integrating office spaces with retail properties enhances foot traffic, creating a symbiotic relationship that benefits both sectors. Workers have easy access to amenities, while retailers enjoy a steady stream of potential customers.

Examples of Successful Office-Retail Integrations

Projects like Vancouver’s Marine Gateway exemplify successful office-retail integration, offering office spaces, retail stores, and residential units in a single, well-connected location.

Impact on Property Value and ROI

Mixed-use developments often see higher property values and better ROI due to their diversified income streams and enhanced appeal to tenants.

Industrial Properties and Retail Integration

Understanding Industrial Properties and Their Role in Retail Supply Chain

Industrial properties, including warehouses and distribution centers, are crucial for retail supply chains. Their proximity to retail hubs ensures efficient inventory management and faster delivery times.

Benefits of Proximity to Retail Spaces

Having industrial properties near retail spaces reduces transportation costs and improves logistical efficiency, benefiting retailers and consumers alike.

Case Studies of Industrial-Retail Property Developments

Developments like the Mississauga Gateway Centre illustrate how industrial and retail properties can coexist, creating logistical hubs that support retail operations.

Future Trends and Predictions

Expect to see more industrial-retail integrations as e-commerce grows and the demand for efficient supply chains increases.

Investment Strategies for Retail Properties

Analyzing Market Trends and Identifying Opportunities

Investors must stay informed about market trends to identify lucrative opportunities. This includes monitoring consumer behavior, economic indicators, and Canadian real estate market cycles.

Risk Assessment and Mitigation Strategies

Assessing risks such as market volatility, tenant defaults, and regulatory changes is essential. Diversification and thorough due diligence can mitigate these risks.

Financing Options for Retail Property Investments

Various financing options are available, from traditional mortgages to private equity. Understanding these options helps investors choose the best financing strategy for their needs.

Tips for Maximizing ROI

Maximizing ROI involves strategic property management, regular maintenance, and adapting to market changes. Leveraging technology and data analytics can also enhance investment outcomes.

Challenges in the Retail Property Market

Common Challenges Faced by Retail Property Investors

Retail property investors face challenges such as economic fluctuations, changing consumer preferences, and increasing competition. Staying adaptable is key to overcoming these hurdles.

Impact of Economic Fluctuations and Consumer Behavior

Economic downturns can affect retail property performance. Understanding and anticipating consumer behavior helps investors navigate these fluctuations.

Strategies for Overcoming These Challenges

Effective strategies include diversifying the tenant mix, incorporating experiential retail, and leveraging technology to enhance customer experiences.

The Role of Technology and Innovation in Addressing Challenges

Innovations such as smart retail technologies, data analytics, and online-to-offline integration can help address challenges and improve property performance.

The Future of Retail Properties

Emerging Trends and Future Predictions

The future of retail properties is shaped by trends such as sustainable development, smart buildings, and the growth of e-commerce. Staying ahead of these trends is crucial for success.

The Impact of E-commerce on Retail Properties

E-commerce is transforming the retail landscape. Retail properties must adapt by offering unique experiences, integrating online and offline channels, and optimizing for last-mile delivery.

Sustainable and Green Building Practices in Retail Developments

Sustainability is becoming a priority in retail development. Green building practices not only benefit the environment but also attract eco-conscious consumers and tenants.

How to Stay Ahead in the Evolving Retail Property Market

Staying ahead requires continuous learning, innovation, and adaptability. Engaging with industry experts, attending conferences, and investing in technology are essential steps.

Retail properties are a dynamic and essential part of the Canadian real estate market. By understanding the intricacies of land development, office spaces, industrial properties, and retail properties, investors can capitalize on opportunities and navigate challenges effectively. Staying informed, adaptable, and innovative is key to success in this evolving market.

FAQs

- What are retail properties? Retail properties are commercial spaces designed for selling goods and services directly to consumers, such as shopping malls, standalone shops, and retail parks.

- Why is location important for retail properties? Location affects foot traffic, visibility, and accessibility, which are crucial for the success of retail properties.

- What are the benefits of mixed-use developments? Mixed-use developments offer a combination of residential, commercial, and retail spaces, creating vibrant, multifunctional areas that enhance property value and ROI.

- How can investors mitigate risks in retail property investments? Investors can mitigate risks through diversification, thorough due diligence, and staying informed about market trends and economic indicators.

- What impact does e-commerce have on retail properties? E-commerce is driving the need for retail properties to offer unique in-person experiences and integrate online and offline channels to stay competitive.

- What are sustainable building practices in retail development? Sustainable practices include using eco-friendly materials, energy-efficient designs, and green technologies to reduce environmental impact and attract eco-conscious tenants.

For further information or professional advice on investing in retail properties, feel free to contact us. Stay tuned for more insights and updates.