In the bustling world of retail, location is paramount. For businesses, selecting a prime retail location can be the difference between soaring success and unfortunate failure. In Canada, a country known for its diverse and dynamic urban landscapes, identifying prime retail locations involves a meticulous analysis of various factors. This blog delves into the essential elements driving prime retail locations, highlights upcoming retail hotspots, and examines how demographics and consumer behavior influence location selection. Furthermore, we provide data-driven insights into foot traffic, sales, and vacancy rates, giving retailers a comprehensive guide to navigating Canada’s retail landscape.

Major Factors Driving Prime Retail Locations

Accessibility and Visibility

Accessibility and visibility are critical in determining a prime retail location. Retailers thrive in areas that are easily accessible to a large number of consumers, with ample parking facilities and convenient public transport links. Visibility ensures that stores capture the attention of potential customers, making high-traffic streets and well-known shopping districts highly desirable.

Economic Stability and Growth

Economic stability and growth within a region significantly impact retail success. Areas with robust economic performance, low unemployment rates, and rising income levels attract both retailers and consumers. Cities like Toronto, Vancouver, and Calgary, with their booming economies, provide fertile ground for retail investments.

Competition and Market Saturation

While a certain level of competition indicates a thriving retail environment, excessive market saturation can deter new entrants. Retailers must balance between being in the midst of bustling retail zones and avoiding overly saturated markets where competition is too fierce.

Real Estate Costs

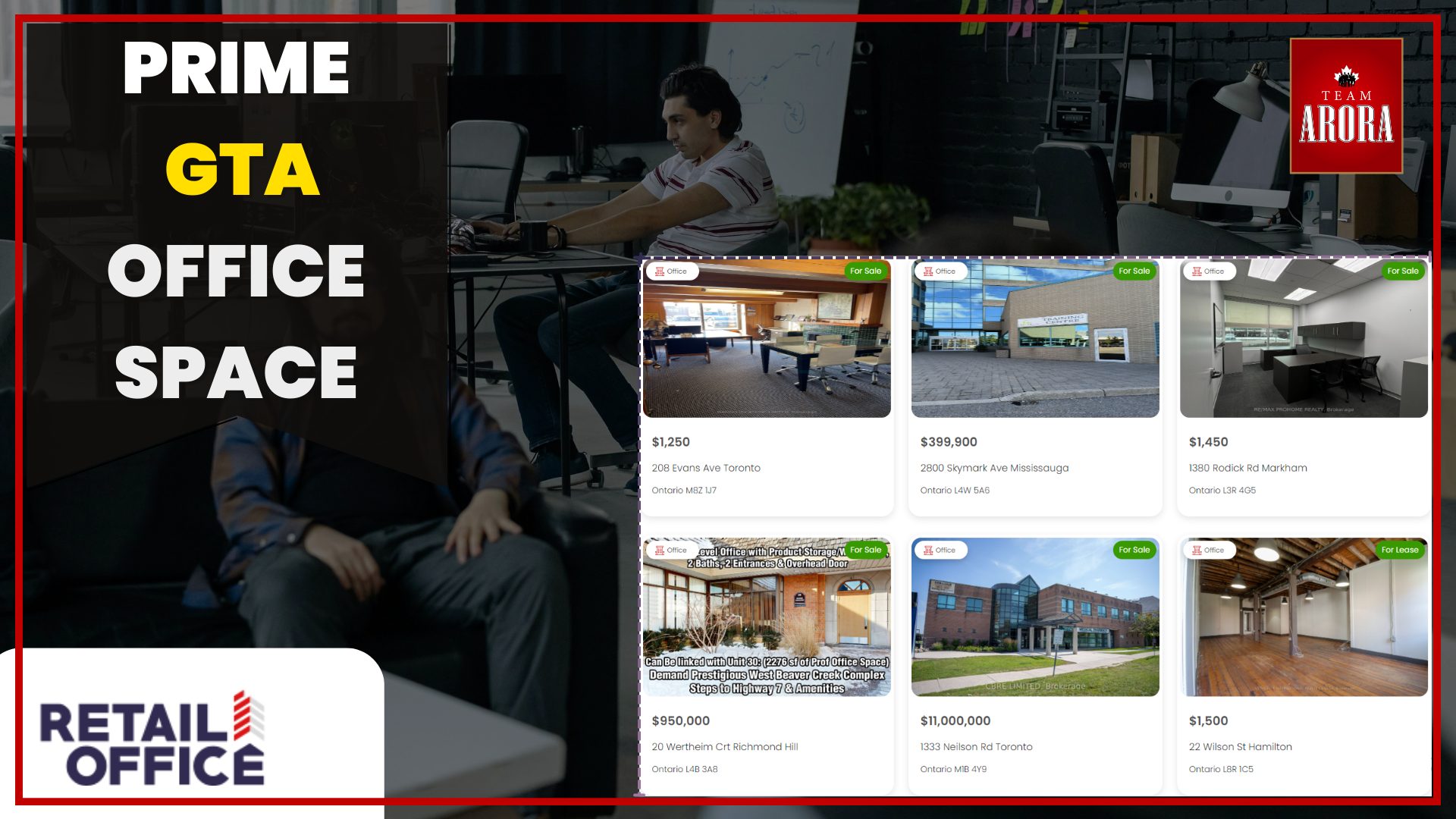

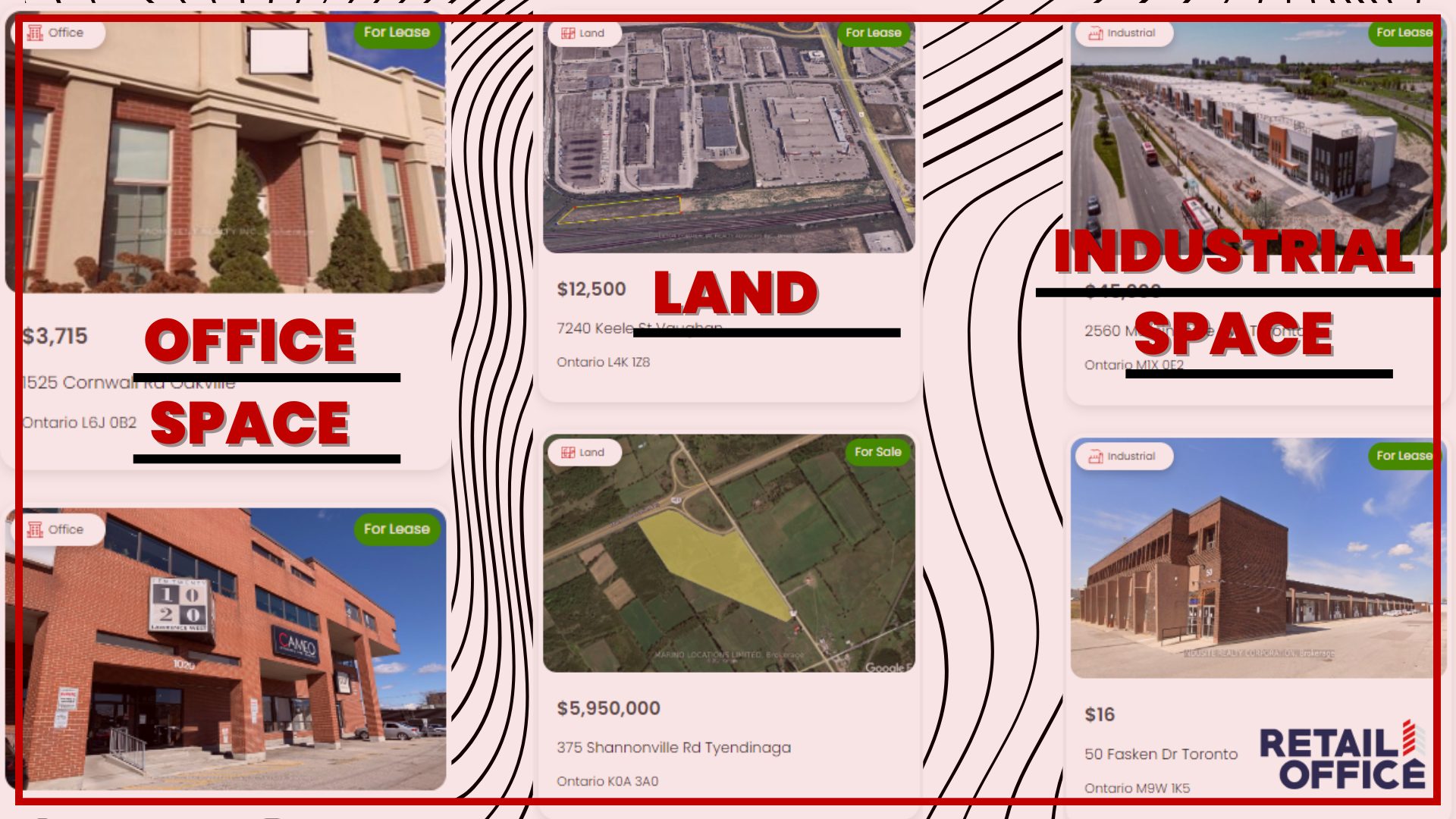

Real estate costs, including rent and property prices, play a crucial role in location selection. Prime locations often come with a hefty price tag, but the potential for higher sales and foot traffic can justify the investment. Retailers must conduct cost-benefit analyses to ensure that the higher costs translate into proportionate revenue.

Upcoming Retail Hotspots in Canadian Cities

Toronto: The Epicenter of Retail Innovation

Toronto remains the epicenter of retail innovation in Canada. The downtown core, especially along Queen Street West and Bloor Street, continues to attract both luxury and mainstream retailers. Emerging neighborhoods like Liberty Village and the Distillery District are becoming trendy hotspots, appealing to younger demographics and tech-savvy consumers.

Vancouver: A Hub of Diversity and Luxury

Vancouver’s retail landscape is characterized by its diversity and luxury appeal. Robson Street and the Pacific Centre are prime locations for high-end retailers. Additionally, areas like Yaletown and Mount Pleasant are gaining popularity, offering a mix of boutique stores, restaurants, and unique shopping experiences.

Montreal: Blending Tradition with Modernity

Montreal blends traditional charm with modern retail trends. Sainte-Catherine Street remains a major retail artery, while neighborhoods like Mile End and Griffintown are becoming trendy retail destinations, attracting artists, young professionals, and tourists.

Calgary: Expanding Retail Frontiers

Calgary’s expanding economy and growing population make it a retail hotspot. The Core Shopping Centre and 17th Avenue SW are established retail hubs, while areas like East Village are rapidly developing, offering new opportunities for retailers.

The Impact of Demographics and Consumer Behavior on Location Selection

Age and Income Levels

Demographics such as age and income levels heavily influence retail location decisions. Younger populations, often found in urban centers and university towns, prefer trendy, fast-fashion, and tech-oriented stores. In contrast, older demographics with higher disposable incomes gravitate towards luxury and high-end retailers.

Consumer Preferences and Trends

Understanding consumer preferences and trends is crucial for selecting the right location. The rise of experiential retail, where shopping is combined with entertainment and dining, has led to the popularity of mixed-use developments. Retailers are increasingly choosing locations within lifestyle centers that offer a holistic shopping experience.

Ethnic Diversity

Canada’s ethnic diversity shapes retail landscapes significantly. Areas with high concentrations of specific ethnic groups often have stores catering to their unique preferences and needs. For instance, neighborhoods with large Asian populations might have a higher density of Asian supermarkets, restaurants, and specialty stores.

Data-Driven Insights into Foot Traffic, Sales, and Vacancy Rates

Foot Traffic Analysis

Foot traffic is a vital indicator of a retail location’s potential. Data from various cities indicate that Toronto’s Eaton Centre and Vancouver’s Metropolis at Metrotown experience some of the highest foot traffic in Canada. Retailers can utilize foot traffic data to gauge the viability of different locations.

Sales Performance

Sales performance varies across regions and retail types. Luxury brands in high-end locations like Vancouver’s Robson Street report higher average sales per square foot compared to mid-range retailers. Understanding sales patterns helps retailers tailor their inventory and marketing strategies to specific locations.

Vacancy Rates

Vacancy rates provide insights into the competitiveness and attractiveness of retail locations. Lower vacancy rates typically signify high demand and stable economic conditions. For instance, Toronto and Vancouver consistently show lower retail vacancy rates compared to other Canadian cities, reflecting their strong retail markets.

Conclusion

Navigating the complex landscape of prime retail locations in Canada requires a deep understanding of various factors, from accessibility and economic conditions to consumer behaviour and demographic trends. By identifying upcoming hotspots and leveraging data-driven insights, retailers can make informed decisions that align with their business goals. As Canada continues to grow and evolve, staying attuned to these dynamics will be essential for achieving long-term retail success.

Prime retail locations in Canada offer immense opportunities, but the key to unlocking their potential lies in a strategic approach grounded in thorough research and analysis. Whether it’s the bustling streets of Toronto, the luxury hubs of Vancouver, the eclectic mix of Montreal, or the expanding frontiers of Calgary, each city presents unique prospects for retailers ready to capitalize on them.

1. What are the key factors to consider when choosing a prime retail location in Canada?

Key factors include accessibility, visibility, economic stability, competition, and real estate costs. These elements help determine the potential for high foot traffic and sales.

2. Which Canadian cities are considered retail hotspots?

Toronto, Vancouver, Montreal, and Calgary are major retail hotspots. Popular areas include Toronto’s Queen Street West, Vancouver’s Robson Street, Montreal’s Sainte-Catherine Street, and Calgary’s 17th Avenue SW.

3. How do demographics influence retail location selection?

Demographics such as age, income levels, and ethnic diversity influence retail preferences, helping determine suitable locations for various types of stores. Younger populations prefer trendy stores, while higher-income areas attract luxury retailers.

4. Why is foot traffic important for retail locations?

Foot traffic indicates the number of potential customers passing by a location. High foot traffic areas typically lead to higher sales opportunities and increased brand visibility.

5. What role do vacancy rates play in selecting a retail location?

Low vacancy rates suggest high demand and stable economic conditions, making those locations more attractive for retailers. High vacancy rates might indicate lower consumer interest or economic challenges in the area.