Are you looking to invest in the booming Canadian real estate market but uncertain of where to start? With 2021 quickly becoming a year of incredible growth for many cities and regions across the country, it can be hard to know which areas are worth considering first. From Toronto’s bustling downtown core, Quebec City’s flourishing new construction industry, or Edmonton’s expanding infrastructure projects – there is no shortage of options when it comes to investing in Canada’s real estate market. But with so many potential places available, investors need comprehensive information on each destination before they commit. In this blog post, we will explore some of Canada’s hottest markets and provide an overview tailored specifically at buyers looking to invest – regardless of whether you are a novice or an experienced investor! So read on as we dive into what makes these various locations special and how your investment could bring you great returns!

Introducing Canada’s Booming Real Estate Markets

From the stunning landscapes of Vancouver to the metropolitan bustle of Toronto, Canada’s real estate market is booming like never before. With a diverse range of properties, buyers and sellers alike are finding Vancouver’s market especially attractive with ample opportunity for growth and potential return on investment. Meanwhile, Montreal’s French-influenced charm and affordable housing options mean a perfect balance of value and location. And let’s not forget Toronto’s competitive, fast-paced market, where investing in a property can not only be profitable but also a smart long-term investment. Whether you are a first-time buyer or a seasoned investor, Canada’s bustling real estate scene offers up endless possibilities.

Vancouver – An Overview of the Market and Investment Opportunities

Vancouver, with its breathtaking scenery and vibrant culture, has long been a hotspot for tourists from all around the world. However, the city offers so much more than just a picturesque backdrop. Its thriving real estate market has made it an attractive investment destination for both local and international investors alike. In recent years, Vancouver has seen a growing demand for high-end properties, particularly in the downtown area. Meanwhile, the city’s strong economic growth and political stability have made it a prime location for businesses looking to expand or establish a presence in North America. With its diverse population and a strong focus on sustainability, Vancouver offers a unique investment opportunity for those looking to make a long-term impact.

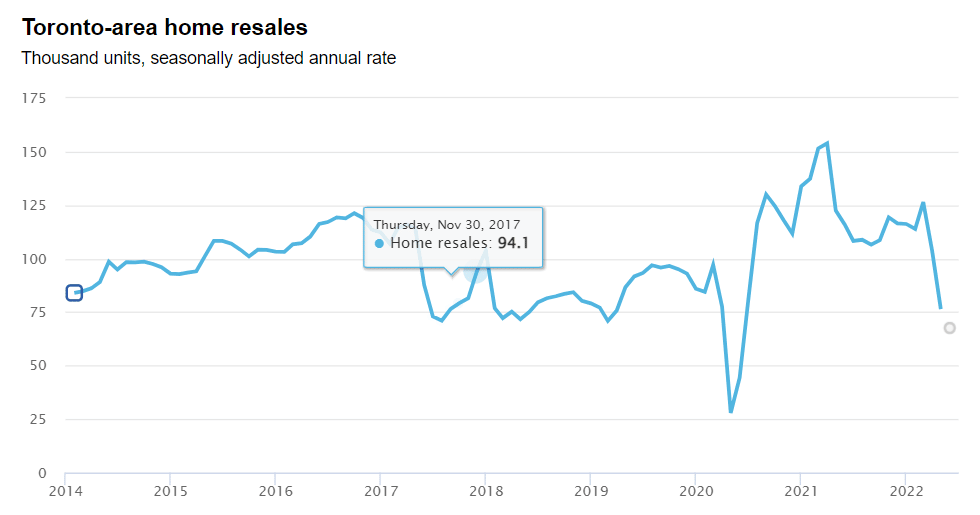

Toronto – A Look at the Market Trends and Potential Returns

Toronto is a city that is constantly changing and evolving, making it an exciting market to watch for potential returns. The real estate market in Toronto has proven to be one of the most promising and lucrative in the country. The continuous growth of the city has pushed housing prices upwards, making it an attractive destination for investors and homeowners alike. However, it is important to stay informed on market trends and developments before making any investment decisions. By keeping a close eye on the market, one can make informed decisions and potentially reap the benefits of the thriving Toronto real estate market. Whether you are a seasoned investor or just starting out, Toronto offers a wealth of opportunities for those looking to capitalize on the evolving market trends.

Calgary – Examining the Local Real Estate Climate and Investment Strategies

Calgary is a vibrant city that is quickly becoming a hot spot for real estate investors. With a growing economy, low unemployment rates, and favorable mortgage rates, investing in the local real estate market could be a wise financial move. But like any investment, it is important to have a thorough understanding of the market before jumping in. By examining the local real estate climate and utilizing effective investment strategies, you can maximize your investment potential and secure a profitable return. Whether you are a seasoned investor or new to the game, Calgary’s real estate market offers plenty of opportunities for those willing to do their research and take calculated risks.

Montreal – Analyzing Market Trends & Investment Chances

Montreal, the largest city in Quebec, Canada, is rapidly becoming a hotspot for real estate investors and industry experts alike. With its diverse populace, rich history, and scenic landscapes, Montreal is attracting significant investments from across the globe. As one of the most multilingual cities in Canada, it’s a melting pot of cultures that offers favorable business opportunities. The local market trends are also confirming its growth potential, with home prices increasing steadily over the years, making Montreal one of the best destinations in North America for real estate investment. From its bustling downtown core to its charming neighborhoods, Montreal has a lot to offer investors looking for a promising property investment opportunity. So, if you’re looking to take advantage of the city’s real estate market growth, Montreal is undoubtedly a city worth exploring.

Ottawa, Surrounding Areas – Examining Potential Growth Areas

Ottawa and its surrounding areas are rapidly emerging as promising grounds for investing in real estate. The city’s economy has been thriving, making it an ideal location for job seekers and businesses alike. With its growing popularity, investment opportunities in the city continue to see significant growth. Whether it’s in the bustling downtown area or in the peaceful suburbs, properties in Ottawa offer an appealing investment opportunity. The potential for development and the creation of new commercial and residential spaces make it an exciting time to explore investment options. With the increasing demand for high-quality, affordable housing, coupled with the city’s reputation for being a desirable place to live, investing in real estate in Ottawa and its surrounding areas has never been more compelling.

In conclusion, Canada is experiencing a booming real estate market and there are potential investment strategies for those wanting to take advantage of this growth. Vancouver offers opportunities for high-return investments in both residential and commercial properties. Toronto’s market trends highlight potential returns and investments in the market share sector. Calgary’s current climate is ripe for investing in land development projects while Montreal provides chances in property acquisition and development investments. Ottawa and its surrounding areas are seeing increased potential growth area investments throughout the region. Each city has something unique to offer investors and presents itself as an attractive option for investment opportunities in today’s marketplace. Canadians should use this period of growth as an opportunity to consider their options when it comes to investing in the Canadian real estate markets.

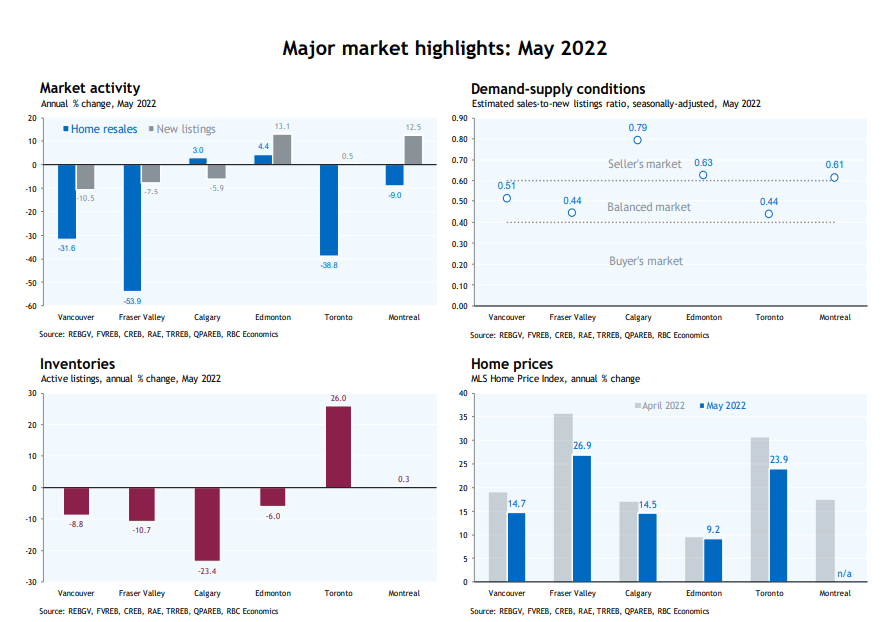

Source: Canadian Real Estate Association, Toronto Region Real Estate Board, RBC Economics | *Yellow dot indicates estimate for May 2022

Source: Canadian Real Estate Association, Toronto Region Real Estate Board, RBC Economics | *Yellow dot indicates estimate for May 2022