Commercial real estate (CRE) has long been regarded as a lucrative avenue for investors seeking to diversify their portfolios and generate substantial returns. Yet, like any investment, CRE carries its share of complexities and misconceptions. Understanding these intricacies is essential for making informed decisions. This article will reveal the truth about commercial real estate investments, covering the advantages, challenges, and key factors to consider when venturing into this dynamic market.

The Benefits of Investing in Commercial Real Estate

1. Income Potential

One of the most attractive aspects of commercial real estate is its income-generating potential. Unlike residential properties, commercial properties typically offer higher rental yields and longer lease terms, providing investors with a stable and predictable cash flow. Tenants in commercial spaces, such as retail stores, offices, and industrial facilities, often sign multi-year leases, ensuring a steady income stream for property owners.

2. Portfolio Diversification

Commercial real estate offers an excellent opportunity for diversification, allowing investors to balance their portfolios with tangible assets that tend to have a low correlation with traditional financial markets. This diversification can help mitigate risks associated with market volatility and economic downturns, as commercial properties may continue to generate income even when stocks and bonds are underperforming.

3. Tax Advantages

Investing in commercial real estate can provide several tax benefits. These include deductions for mortgage interest, property depreciation, and operating expenses, which can significantly reduce taxable income. Additionally, investors can benefit from tax-deferred exchanges, such as the 1031 exchange in the United States, allowing them to defer capital gains taxes by reinvesting proceeds from the sale of one property into another.

4. Appreciation Potential

Commercial real estate has the potential for long-term appreciation, especially in high-demand markets. Property values tend to increase over time due to factors such as population growth, economic development, and urbanization. By strategically investing in locations poised for growth, investors can realize substantial capital gains.

The Challenges of Commercial Real Estate Investment

1. High Entry Costs

One of the most significant barriers to entry in commercial real estate is the substantial capital investment required. Acquiring commercial properties typically involves higher upfront costs than residential properties, including down payments, closing costs, and renovation expenses. This can be a deterrent for some investors, especially those with limited resources.

2. Market Volatility

While commercial real estate offers diversification benefits, it is not immune to market fluctuations. Economic downturns, changes in consumer behavior, and shifts in industry trends can impact property values and occupancy rates. Investors must be prepared for potential market volatility and have contingency plans to mitigate risks.

3. Management Complexity

Commercial landlords often deal with multiple tenants, each with unique lease agreements and maintenance requirements. Additionally, property managers must comply with various regulations and zoning laws, adding another layer of complexity to the management process.

4. Limited Liquidity

Commercial real estate is considered a relatively illiquid asset, meaning it cannot be easily converted into cash. Selling a commercial property can be a lengthy process involving negotiations, due diligence, and legal procedures.

Consider When Investing in Commercial Real Estate

1. Location, Location, Location

The old adage “location, location, location” holds true in commercial real estate. The success of an investment largely depends on the property’s location. Factors to consider include proximity to major transportation hubs, population density, economic activity, and accessibility. A prime location can attract high-quality tenants and ensure long-term appreciation.

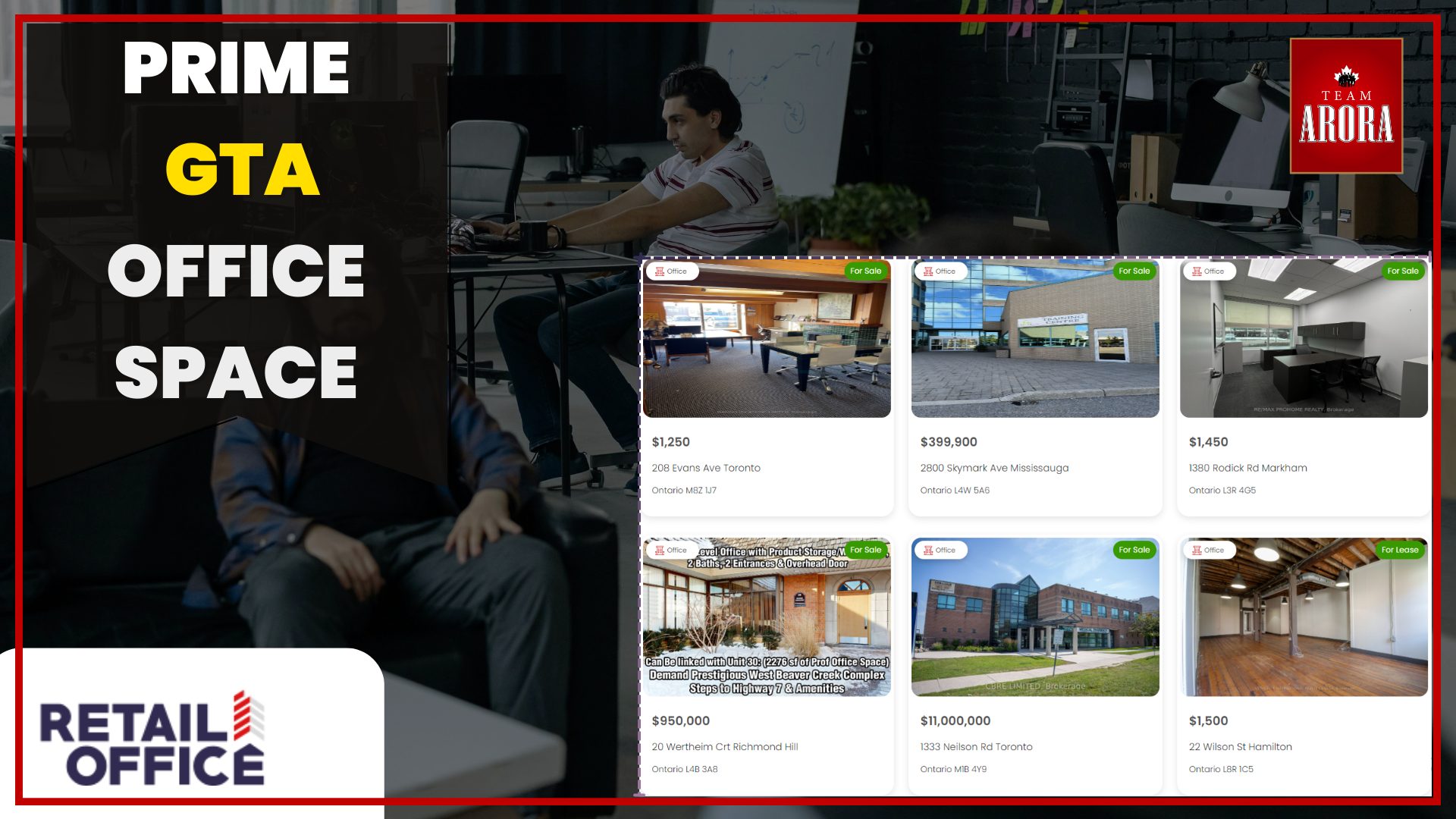

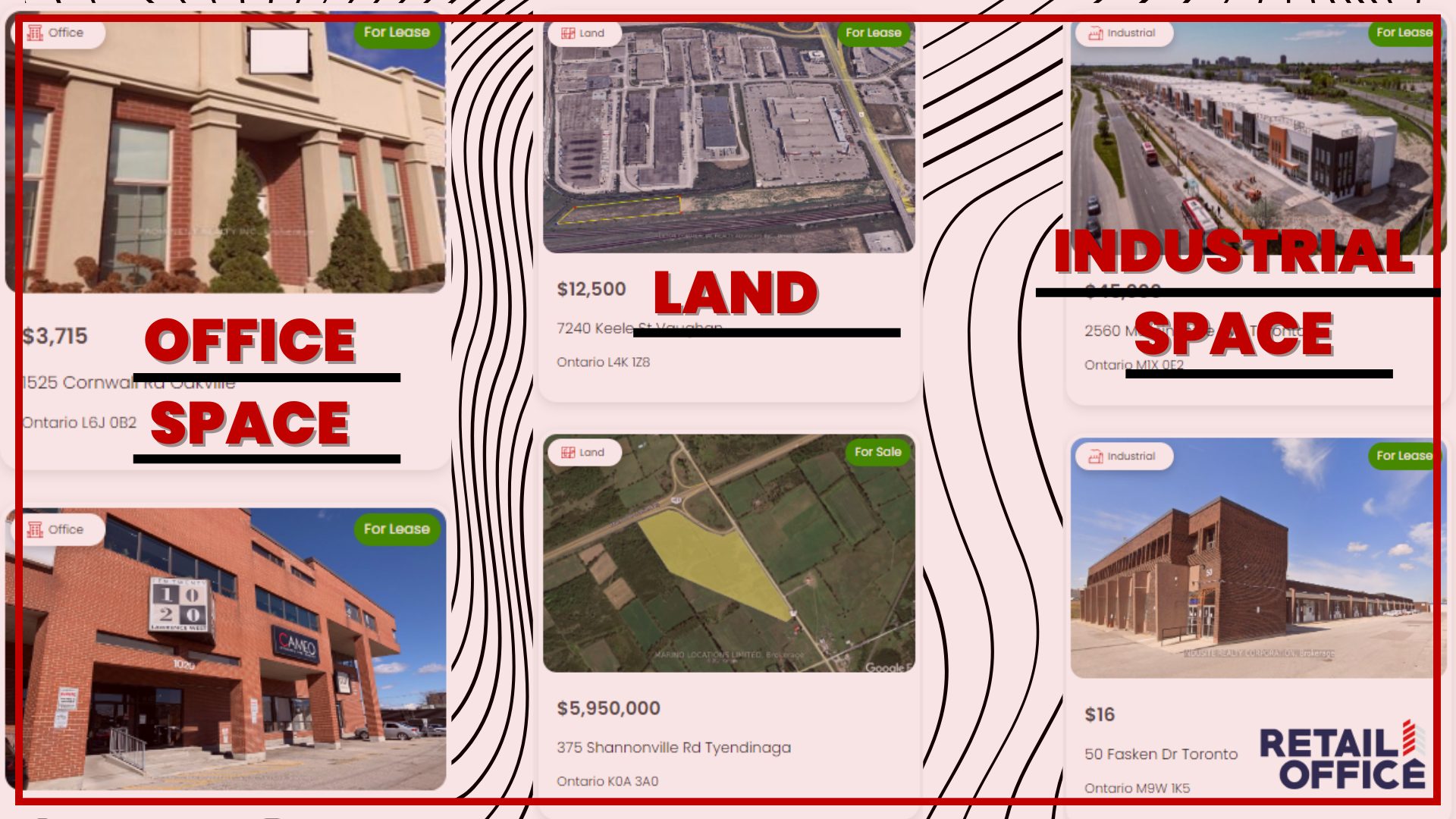

2. Property Type and Sector Trends

Investors should carefully consider the type of commercial property they wish to invest in, whether retail, office, industrial, or multifamily. Each property type has unique market dynamics and trends that can influence investment performance. For example, the rise of e-commerce has significantly impacted retail spaces, while the demand for flexible office spaces has increased due to remote work trends.

3. Tenant Quality and Lease Structure

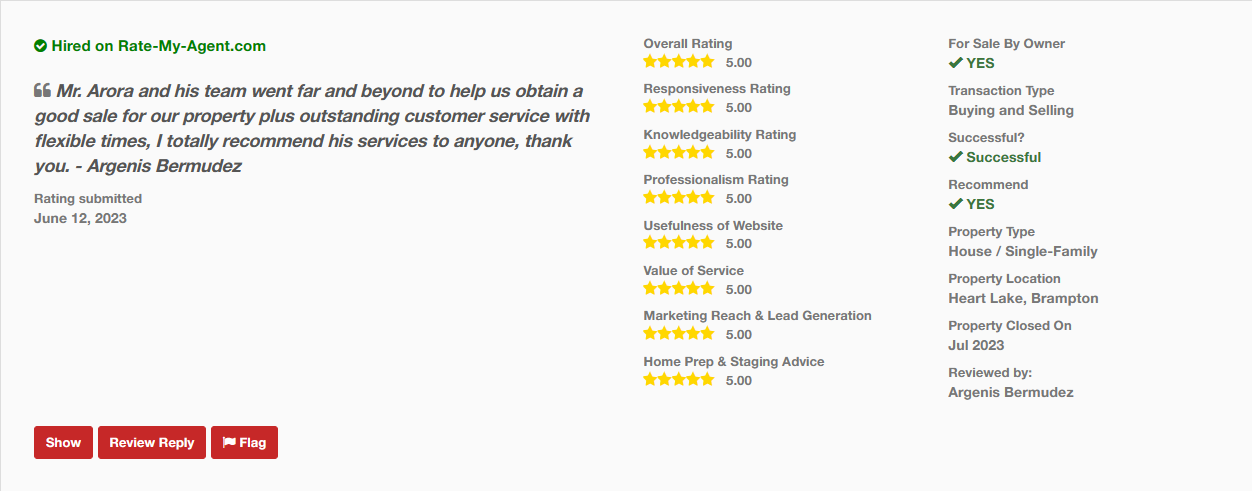

The quality of tenants and the structure of lease agreements are critical factors in determining the success of a commercial real estate investment. Reliable tenants with strong financial backgrounds can ensure a steady income stream and minimize vacancy risks. Additionally, long-term leases with favorable terms provide stability and reduce turnover costs.

4. Due Diligence and Risk Assessment

Conducting thorough due diligence is essential before making any commercial real estate investment. This involves analyzing financial statements, property conditions, market trends, and potential risks. Investors should also consider hiring professionals, such as real estate attorneys and property inspectors, to ensure comprehensive evaluations.

5. Financing Options and Leverage

Understanding financing options and the role of leverage is crucial for commercial real estate investors. While borrowing can amplify returns, it also increases risk. Investors should carefully assess their debt-to-equity ratios and explore various financing options, such as traditional loans, commercial mortgage-backed securities (CMBS), and private equity partnerships.

Navigating the Future of Commercial Real Estate

1. Embracing Technology and Innovation

The commercial real estate industry is evolving rapidly, driven by technological advancements and changing consumer preferences. Investors who embrace innovation can gain a competitive edge. This includes adopting smart building technologies, utilizing data analytics for decision-making, and exploring sustainable building practices.

2. Adapting to Market Shifts

The COVID-19 pandemic has accelerated several market shifts, including remote work adoption and e-commerce growth.

3. Focus on Sustainability and ESG Initiatives

Sustainability and environmental, social, and governance (ESG) considerations are becoming increasingly important in commercial real estate. Properties that meet high sustainability standards can attract socially conscious tenants and investors. Implementing energy-efficient systems and sustainable practices can also reduce operating costs and enhance property value.

Commercial real estate investments offer significant income potential, diversification benefits, and tax advantages. However, they also come with challenges such as high entry costs, market volatility, and management complexity. By understanding the truth about commercial real estate investments and considering key factors like location, tenant quality, and market trends, investors can make informed decisions and navigate the dynamic landscape of commercial real estate. Embracing technology, adapting to market shifts, and focusing on sustainability can further enhance investment success and ensure long-term growth in this ever-evolving industry.