Are you looking to make a big return on your investment in the real estate market? You are certainly not alone. With prices rising constantly, it is becoming increasingly difficult for investors to get ahead and cash in on their investments. Thankfully, our team of professionals has been working in the market for years and has compiled a list of tips that can help you maximize your gains while being mindful of potential risks. Keep reading this blog post to learn more about how best to invest in today’s market and gain an advantage over other investors!

Understand the Real Estate Market

Do your research and understand market trends

If you are looking to buy or sell a property, it is crucial to understand the real estate market and stay up-to-date on market trends. Researching the current state of the market and analyzing past trends can help you make informed decisions and avoid costly mistakes. Stay informed on factors such as interest rates, supply and demand, and the local economy to have a better understanding of what direction the market is heading in. Doing your research ahead of time can save you time, and money and relieve some of the stress of buying or selling a property. Remember to also work with a reputable real estate agent who can assist you with navigating through the complex process of buying or selling a home.

Create a Budget and Stick to It

Set aside a budget for costs such as renovations, maintenance, and taxes

Creating a budget is a crucial aspect of managing your finances, especially when it comes to ownership of property. When you purchase a home, you not only have mortgage payments to consider but also other expenses such as taxes, renovations, and maintenance. By setting aside a budget for these costs, you can ensure that you can handle any unexpected expenses that may arise. It’s important to stick to your budget and resist the temptation to overspend. With discipline and careful planning, you can successfully manage your finances and enjoy the benefits of owning a property without the stress of financial burden.

Analyze Market Data or News

Keep up with the latest news to stay in the know

Being informed is key in the fast-paced world of business. By analyzing market data and following the latest news, you can stay ahead of the game and make informed decisions. Market data allows you to gain insights into consumer behaviour, trends and patterns, while news alerts you to any changes in the industry or economic landscape that could affect your business. Knowing what’s happening in the market can help you identify opportunities for growth, stay ahead of the competition and make strategic decisions that will benefit your business in the long run. So, stay informed and always be in the know by analyzing market data and keeping up with the latest news.

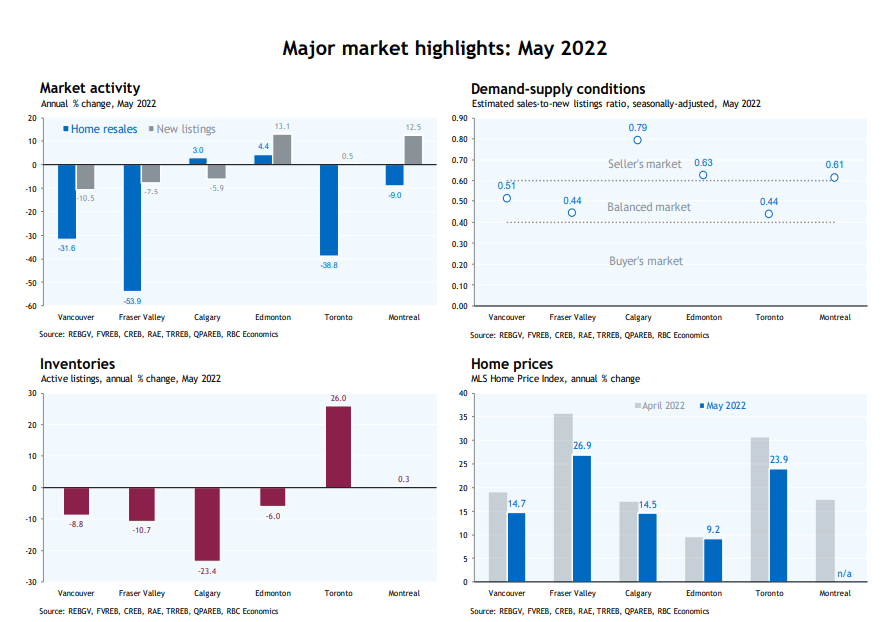

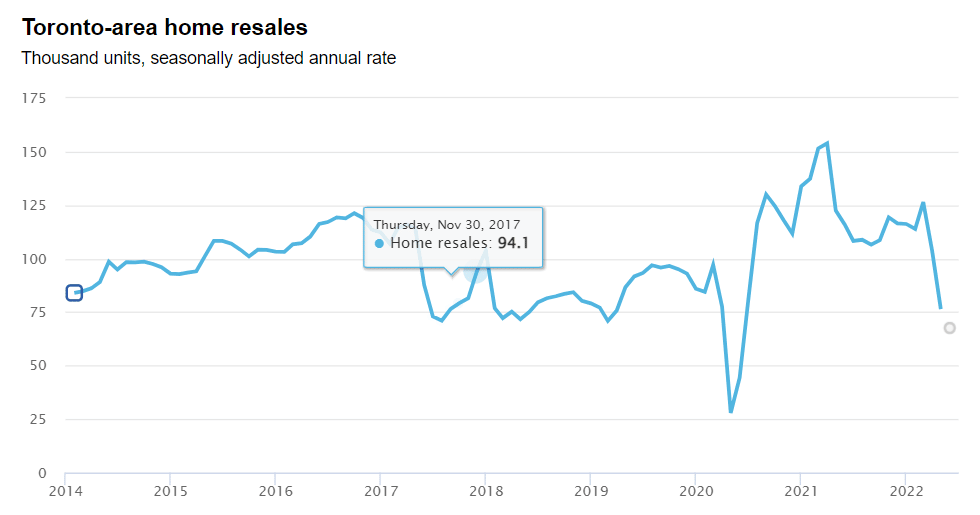

Source: Canadian Real Estate Association, Toronto Region Real Estate Board, RBC Economics | *Yellow dot indicates estimate for May 2022

Source: Canadian Real Estate Association, Toronto Region Real Estate Board, RBC Economics | *Yellow dot indicates estimate for May 2022